Category Archives: banking

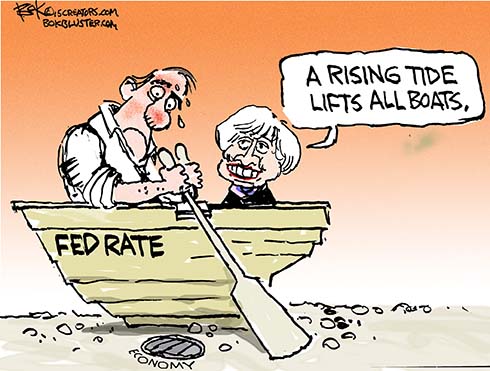

Fed Up

The Fed has kept the stock market and, so it claims, the U.S. economy afloat with low interest rates. The Dow lost 1500 points in the past week. World economic growth is stuck in the mud.

And with interest rates near zero, the Fed is low on flotation devices.

If income inequality is your thing, cheer up. Jeff Bezos lost $2.6 billion on Monday. Bloomberg has the fat cat score card here.

Craigslist for Greeks

Greece’s Syriza Party Prime Minister Alexis Tsipras agreed to accept new conditions for a bail-out from Germany. The conditions are tougher than the ones Greek voters rejected in a referendum less than two weeks ago. The agreement also calls for a €50 billion investment fund to help Greece grow out of its mess. The fund is to endowed by the sale of Greek assets. Craigslist for Greeks.

The agreement requires approval of the Greek Parliament.

In a WSJ piece title “Another Greek Can-Kicking” Holman Jenkins thinks the deal will retard any return to health for Greece.

But if you still have money in Greek banks you might be willing, to sacrifice the economy’s return to long-term health to maximize your chance of reclaiming your life savings.

He also says the deal was less about Greece than preserving relations between France and Germany.

France stepped out as defender of Greece and promoter of fake plaudits… Germany likes to be seen deferring to France to quell any idea that Germany is becoming strident and imperialistic again.

It must be true – David Ignatius lays out the same notion in the Washington Post.

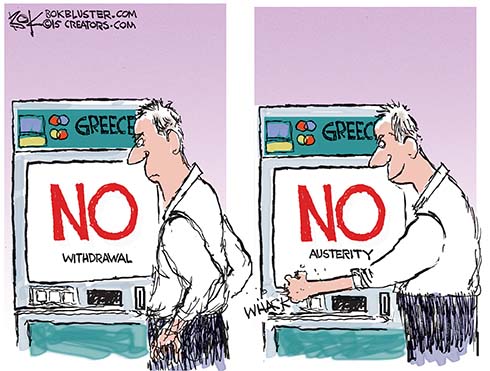

Greek Austerity

Last week Greece defaulted on its debt to the IMF. On Sunday Greek voters said “no” to more austerity from the IMF.

Last week Greece defaulted on its debt to the IMF. On Sunday Greek voters said “no” to more austerity from the IMF.

Surging socialist candidate Bernie Sanders applauds the Greeks for rejecting austerity from the Euro ruling class. Economics writer Stephen Moore says Greece needs less socialism and more privitization. The banks are shutting down and withdrawals are restricted. He says what’s happening in Greece is the usual outcome of socialism – economic collapse.

Roger Cohen in the NYT says the euro zone isn’t all that much into democracy anyway: “A vote cannot undo a debt or obscure colossal Greek irresponsibility.”

The IMF had demanded more taxes on Greek businesses. Moore says the country is already overtaxed. His solution is a Detroit style bankruptcy where pensioners and Wall Street investors all take a “haircut”.

Robert Samuelson says the Greek economy accounts for only 1.8% of the euro zone and its collapse might not have much effect on the rest of us. Greece only has a population of 11 million. Hell, we have 94 million out of work.

But this WSJ analysis says if Greece does leave the Eurozone the risk of contagion to more important economies is high.

Financial Struggles of Rubio and Hastert

The NYT is on Marco Rubio’s case. The paper reported he’s had 4 traffic tickets in 17 years! Not only that, he used an $800,000 book advance to pay off $100,000 in student loans and buy an $80,000 fishing boat – or a “luxury speed boat”. All this packed into not one, but two stories. The second story appeared on Wednesday’s front page under the headline Rubio Career Bedeviled by Financial Struggles.

The NYT is on Marco Rubio’s case. The paper reported he’s had 4 traffic tickets in 17 years! Not only that, he used an $800,000 book advance to pay off $100,000 in student loans and buy an $80,000 fishing boat – or a “luxury speed boat”. All this packed into not one, but two stories. The second story appeared on Wednesday’s front page under the headline Rubio Career Bedeviled by Financial Struggles.

The editors seem unaware that Rubio’s financial struggles are the same struggles bedeviling a lot of normal people. Jon Stewart is on The Times’ case.

Meanwhile a picture directly above the Rubio story, in the print edition, features the financial struggles of former House Speaker Dennis Hastert. Hastert’s struggles aren’t so much like those of normal people. He’s accused of agreeing to pay $3.5 million in blackmail. Paying blackmail isn’t illegal, but using your own cash to do it is, if you withdraw over $10,000. Hastert tried to avoid that by taking out less than 10 grand more often. Apparently that’s illegal too.

Jon Kass of the Chicago Tribune is not happy with Dennis Hastert.

Ben Bernanke’s Money

What good is quantitative easing if Ben Bernanke can’t get a loan? The former Fed chairman confided last week that he was unable to refinance his $850,000 home mortgage. It’s true he’s out of a job but ex-government swells are never out of the money. Bernanke is still making the stuff from thin air (or hot air) by cranking out speeches at more than $200,000 a pop.

Helicopter Ben Bernanke

IBD notes that even Barney Frank now lays some blame on the government for the 2008 banking crisis. It forced banks to lend to risky home buyers and now Dodd Frank is overcorrecting by putting the clamps on the banking industry. Banks have been forced to close branches to pay penalties. They’re sitting on piles of free money but they’re reluctant to lend, even to Helicopter Ben.

In that same speech he also discussed how the government can always avoid deflation by printing more dollars and referred to a statement made by Milton Friedman, a Nobel Prize winning economist, about using a helicopter drop of money to fight deflation. Since then, Bernanke has had the nickname of “Helicopter Ben.”