Category Archives: banking

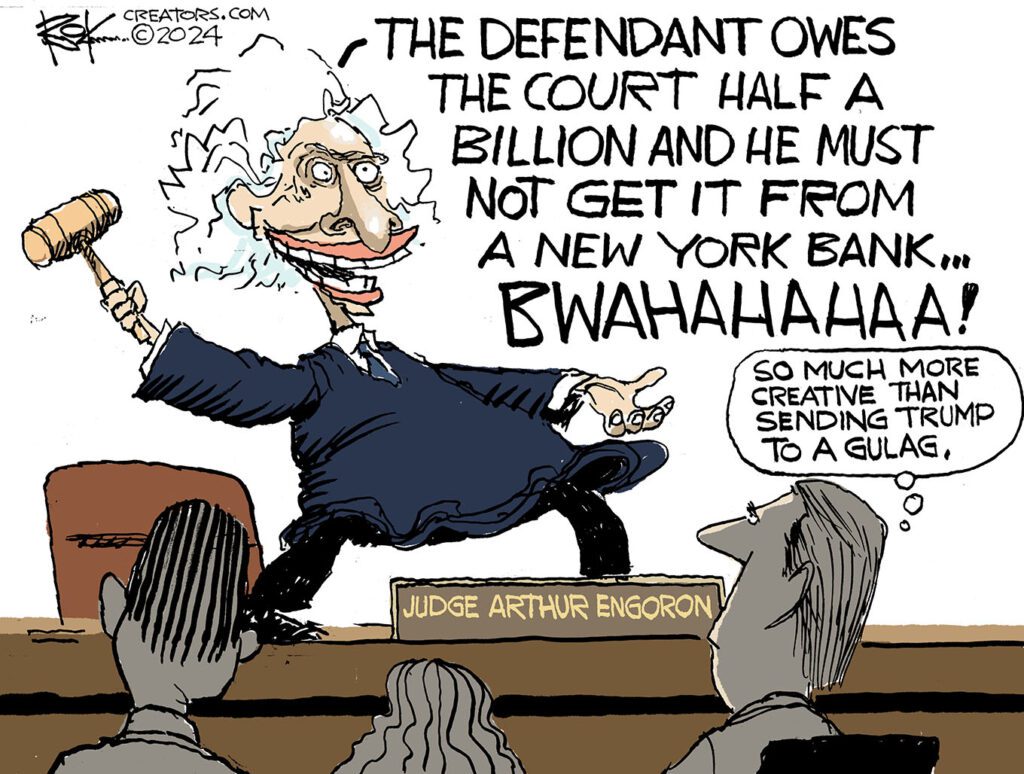

Judge Protects Deutsche Bank From Trump

Vladimir Putin sends his rivals to The Gulag. Joe Biden sends his to Judge Arthur Engoron.

Locked Down Traders flush Wall Street Elite

Locked down, lost your job? Have some fun flushing a hedge fund.

I ran across this update on an old prank in Thursday’s Wall Street Journal:

On Discord, in a chat room linked to WallStreeBets, a user on Tuesday posted, “Guys, we need to pump $GME. Everyone buy 1000 shares in exactly 60 seconds.”

WSJ, Individual Investors Rout Hedge Funds, p. 10, 1/28/2021

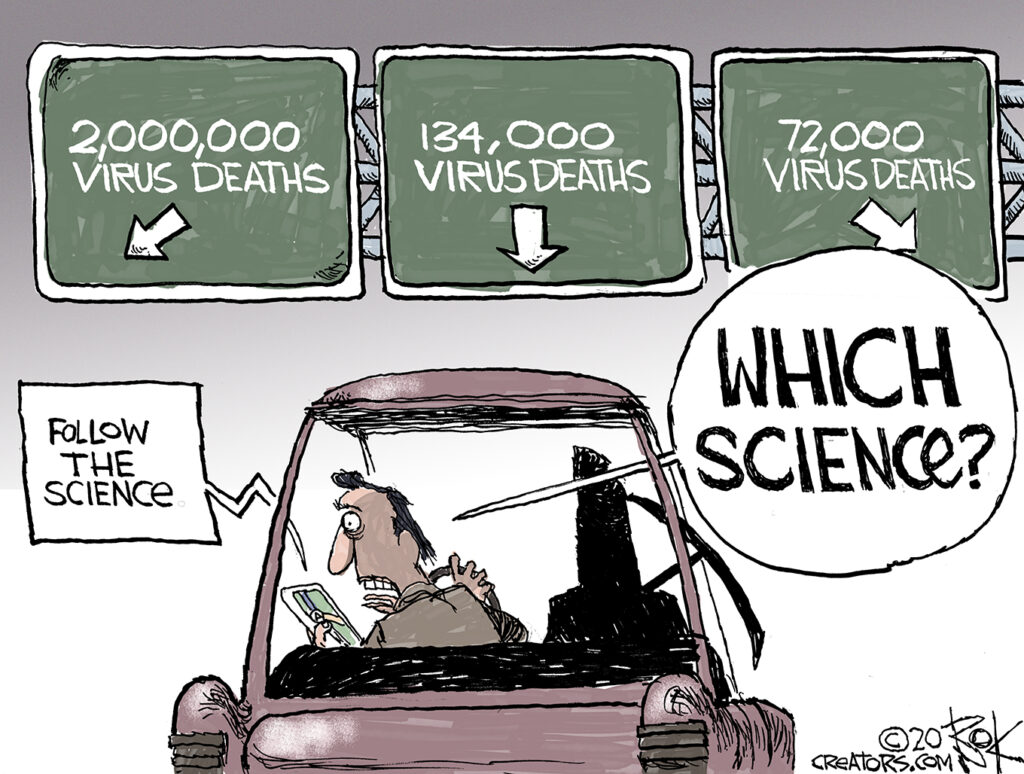

Follow The Science of the Covid Pandemic

We’re often told told that truth is relative. That is except when it comes to “The Science.” Then it’s absolute. And we must follow the science.

But it’s kinda tough to pin down “The Science.” It’s always changing. Especially when it comes to Covid 19 models.

A piece by an economist named Brian Wesbury appeared in Real Clear Politics comparing the 2008 mortgage crisis to the current covid crisis. Lenders in 2008 were required to value their assets at market prices. It’s called marking to market. The idea was to “insist on the truth.” But the truth was that the mortgage market didn’t want the stuff. So the banks failed and the larger markets crashed.

Now Wesbury says pandemic authorities want us to mark to scientific models. But the models have never been accurate:

States and municipalities shut down their economies — based on models that predicted 2.2 million deaths in the United States. Hospitals, they said, would be overwhelmed, so we must flatten the curve. The result? They flattened the economy, risking even more lives in the process, and generated panic that made the markets illiquid!

Brian Wesbury – Real Clear Politics

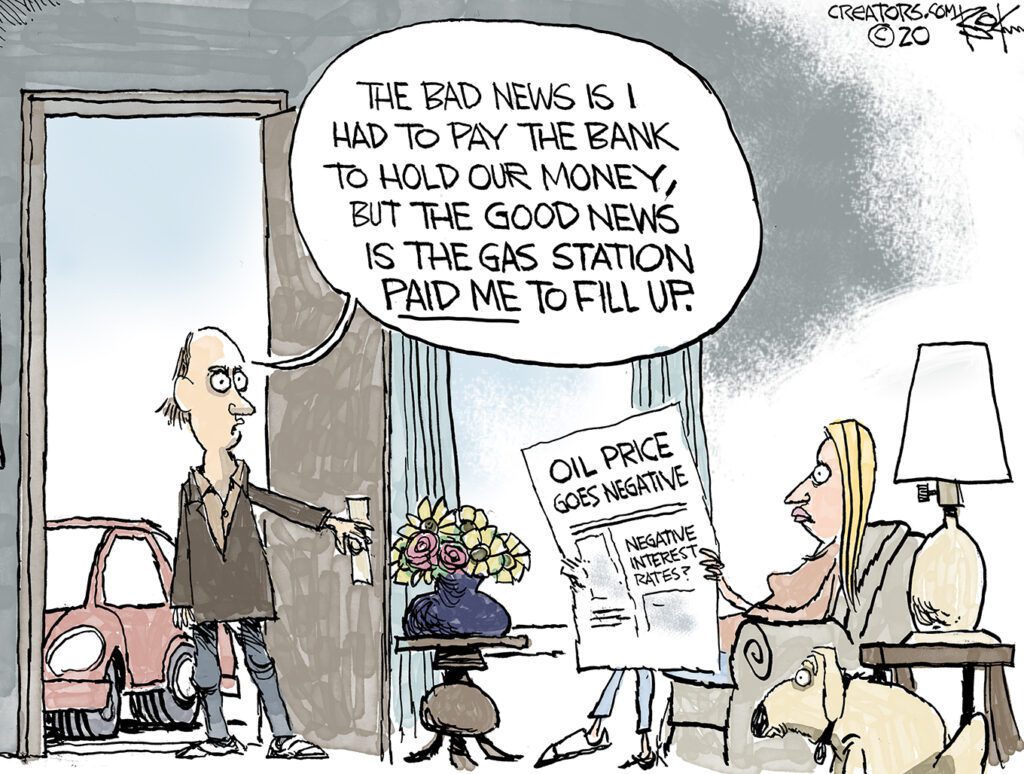

Oil Has a Negative Attitude

Now even oil has a negative attitude. The price of West Texas Crude went negative yesterday. Nobody wants to buy the stuff. So producers were theoretically willing to pay you $37.63 at one point to take a barrel off their hands.

That was the price on a May contract which expires today. So if you have a tanker parked somewhere, now’s the time. The price on June contracts and later should move back up to positive territory.

Pippa Stevens at CNBC explains why.

Meanwhile, negative interest rates could be on the way to a bank near you. Thanks to negative rates in Europe and Japan, savers pay institutions there to store their money for them.

And, if you’re feeling nostalgic, here’s a cartoon in memory of high gas prices.

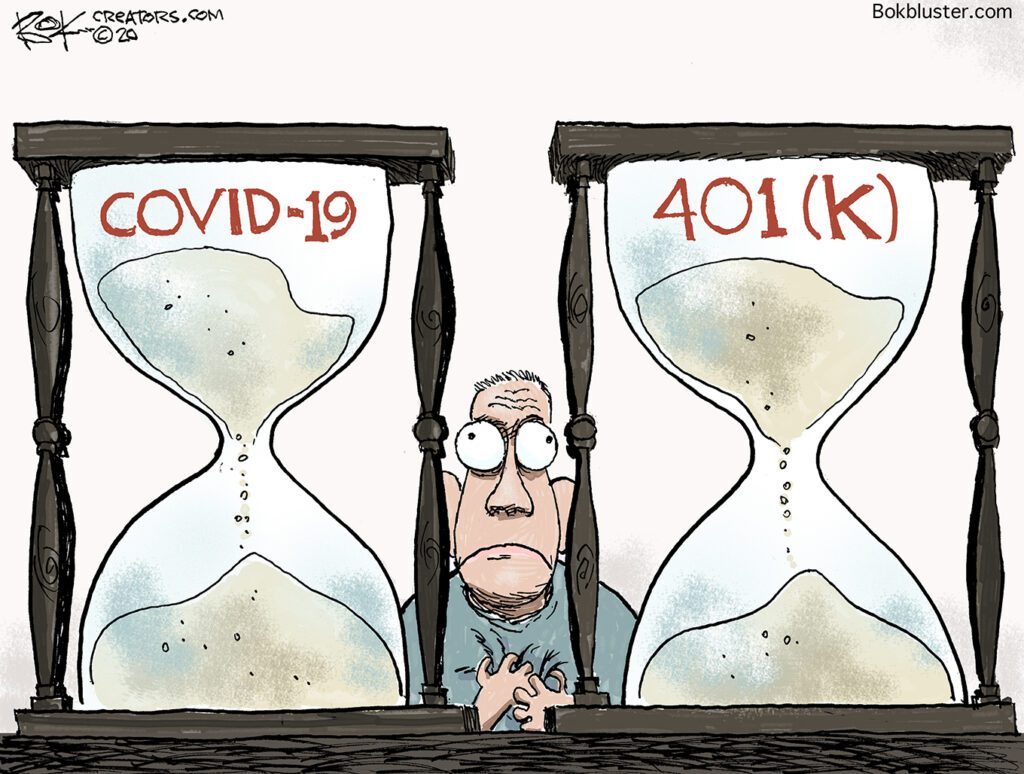

Race Against Time, Virus vs. Savings

It’s a race against time. Can the virus be spent before your savings?

701,000 American jobs were lost in March and the unemployment rate rose from 3.5% to 4.4% in one month according to the WSJ.

Meanwhile, The Guardian says about 35 companies are working on a vaccine and Moderna is about to begin human testing. And “many many‘ groups are working on immunity-giving antibody tests that provide results in minutes.