Category Archives: stock market

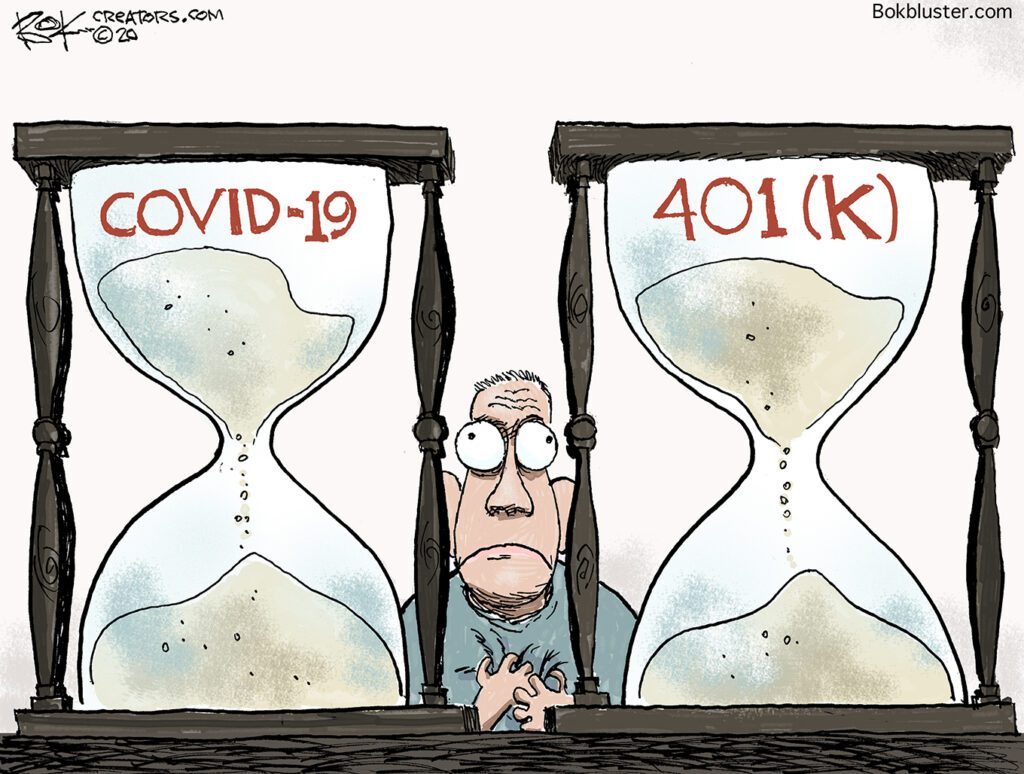

Race Against Time, Virus vs. Savings

It’s a race against time. Can the virus be spent before your savings?

701,000 American jobs were lost in March and the unemployment rate rose from 3.5% to 4.4% in one month according to the WSJ.

Meanwhile, The Guardian says about 35 companies are working on a vaccine and Moderna is about to begin human testing. And “many many‘ groups are working on immunity-giving antibody tests that provide results in minutes.

Economy Not Sheltering in Place

The economy isn’t sheltering in place. It’s heading down. Fast.

Goldman Sachs forecasts 15% unemployment and a 34% decline in GDP in the second quarter. And the stock market just finished its worst quarter since 2008.

Goldman Sachs is still predicting a “V-shape” recovery, however, meaning the steep drop-off will lead to a bigger bounce of 19 percent in the third quarter.

The Hill

Economy Not Sheltering

The election is seven months away. Can Trump pull the economy out of its Corona nose dive by then?

Scott Brennan, an Iowa Democratic National Committee member and a former state party chairman, said, “If the economy pops back … it’s hard to know what people are going to think.”

Politico

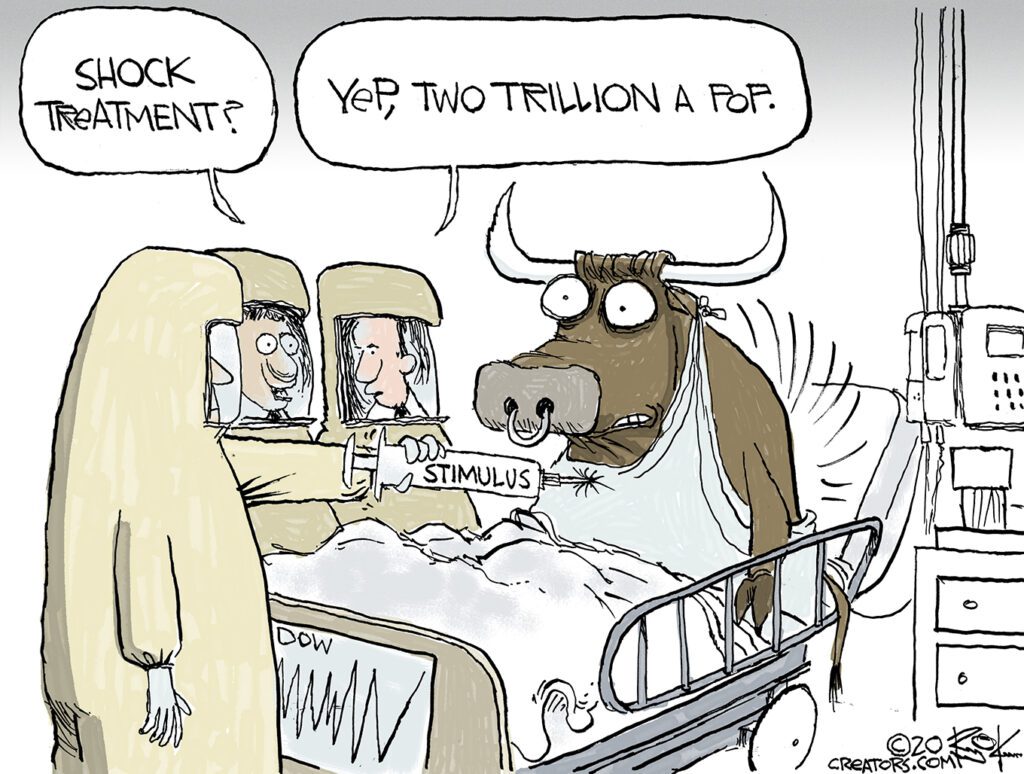

Two Trillion Dollar Stimulus Brings Back Bull, For Now

The Senate passed a two trillion dollar stimulus bill Wednesday night. And the Dow lurched forward 6.4% on Thursday. And that followed an 11% bump from the day before. But the 401k party was over by Friday and it was still down over 20% for the year.

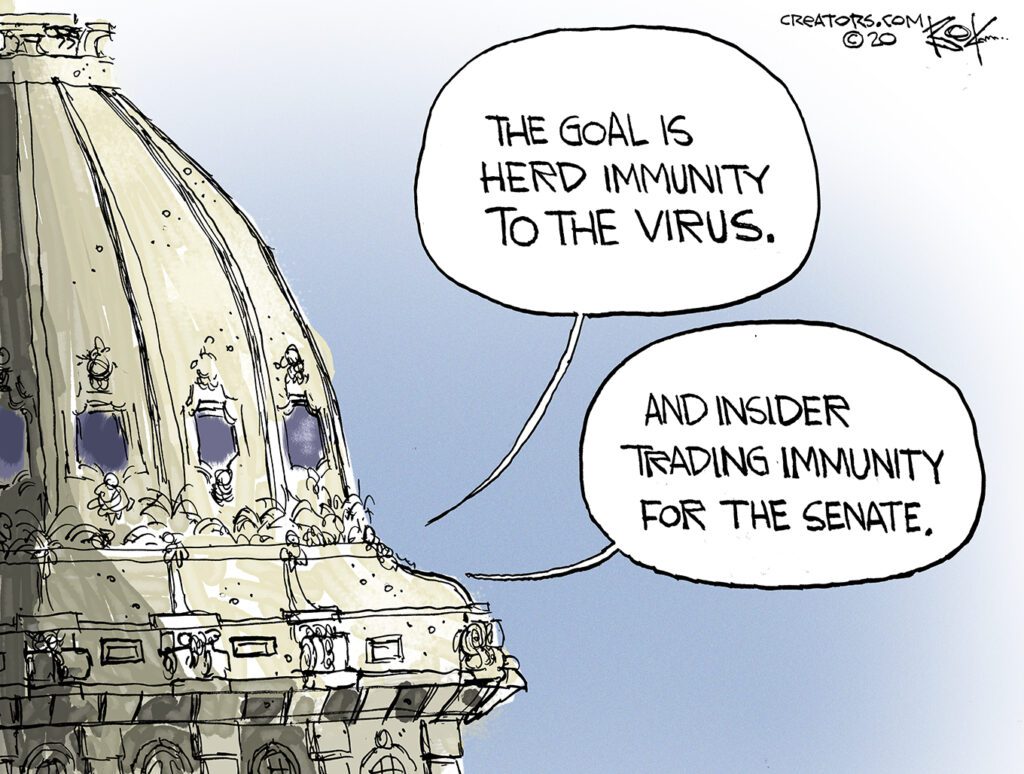

Senate Stock Market Tycoons

White House and Senate agreed to a $2 trillion stimulus deal for the economy. And the economy likes it. The Dow shot up 11% for its best day since 1933.

Speaking of stocks and Senators, some senators dumped stocks just before Corona virus market meltdown.

Senate Stock Market Tycoons

Here’s Professor Jonathan Turley writing in The Hill:

Senators Richard Burr, Kelly Loeffler, James Inhofe, and Dianne Feinstein together are responsible for as much as $11 million in recent stock sales. It turns out that many lawmakers become market investment geniuses after they enter Congress. A University of Memphis study found that 75 percent of randomly selected members had made “stock transactions that directly coincided with legislative activity.” A Georgia State University study noted that, from 1993 to 1998, senators beat the stock market by 12 points with their portfolios and outperformed “corporate insiders” by 8 points.

Cure Worse than Disease?

Is the cure worse than the disease? The war against the Covid-19 virus is destroying businesses and jobs. The Wall Street Journal in an editorial titled Rethinking the Coronavirus Shutdown thinks maybe so:

In a normal recession the U.S. loses about 5% of national output over the course of a year or so. In this case we may lose that much, or twice as much, in a month.

Our friend Ed Hyman, the Wall Street economist, on Thursday adjusted his estimate for the second quarter to an annual rate loss in GDP of minus-20%. Treasury Secretary Steven Mnuchin’s assertion on Fox Business Thursday that the economy will power through all this is happy talk if this continues for much longer…

And David Katz, the founding director of the Yale- Griffin prevention research Center, wrote in the New York Times

I am deeply concerned that the social, economic and public health consequences of this near total meltdown of normal life — schools and businesses closed, gatherings banned — will be long lasting and calamitous, possibly graver than the direct toll of the virus itself.

…A pivot right now from trying to protect all people to focusing on the most vulnerable remains entirely plausible. With each passing day, however, it becomes more difficult. The path we are on may well lead to uncontained viral contagion and monumental collateral damage to our society and economy. A more surgical approach is what we need.