Category Archives: stock market

Hillary Fixes Wall Street

Hillary didn’t appreciate Bernie Sanders’ comments about her millions and millions in contributions from Wall Street. Bernie thinks big shot investment bankers expect a return on their investment in Hillary.

Hillary didn’t appreciate Bernie Sanders’ comments about her millions and millions in contributions from Wall Street. Bernie thinks big shot investment bankers expect a return on their investment in Hillary.

Hillary took offense. She said Bernie had questioned her integrity. Who doesn’t?

Hillary immediately threw down the gender card, claiming most of her contributions come from women. Then she played the 9/11 card. She reminded us that she was a Senator from New York. And that New York had suffered an attack by Islamic, well, terrorists on 9/11. And that the attack happened near Wall Street. All that money was for Wall Street repairs.

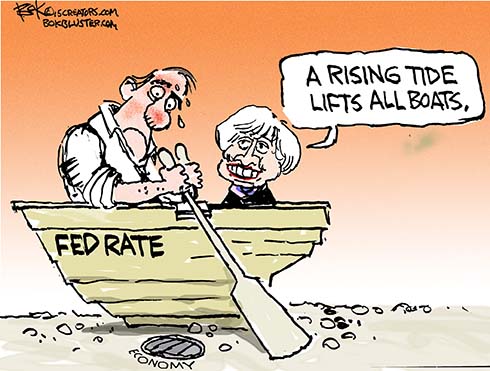

Fed Up

The Fed has kept the stock market and, so it claims, the U.S. economy afloat with low interest rates. The Dow lost 1500 points in the past week. World economic growth is stuck in the mud.

And with interest rates near zero, the Fed is low on flotation devices.

If income inequality is your thing, cheer up. Jeff Bezos lost $2.6 billion on Monday. Bloomberg has the fat cat score card here.

Conspiracy Theory

It must be a conspiracy. The stock market lost all its gains for the year this past week. So naturally as I post this the markets are soaring.

Economic Patriotism

President Obama’s favorite billionaire is making a run for the border. Warren Buffett’s Berkshire Hathaway will finance Burger King’s purchase of Canadian donut dynamo, Tim Hortons.

Economic Patriotism

As a Canadian operation, Burger King will still have to pay US corporate taxes on earnings inside the United States. But earnings outside the US will only be taxed at the rate of the country where they occur. US companies have to pay taxes in the countries where they operate and also must pay IRS the difference between those rates and the US rate. The Obama administration calls this economic patriotism.

Burger King’s move is called a tax “inversion”. Matt Levine gives a great explanation in this Bloomberg article.

The US corporate rate, including state and local taxes comes to about 40%. That’s the highest in the world outside the Islamic State jizya. Roberto A. Ferdman provides a nice chart in the Washington Post showing the tax rates of the 34 OECD countries.

The nominal corporate tax rate in the U.S., which combines national, state, and city-level tax rates, is nearly 40 percent—the highest across all 34 Organization for Economic Cooperation and Development (OECD) member countries. Canada’s, by comparison, is just over 26 percent.

Backdoor Wall Street Bailout

Our magic president has appointed a new Fed chief to make more magic money.

Our magic president has appointed a new Fed chief to make more magic money.

Janet Yellen’s Senate hearing for approval to succeed Ben Bernanke began yesterday.

Backdoor Wall Street Bailout

Andrew Huszar, a former bond buyer for the Fed, wrote an interesting apology in the WSJ this week for his role in “quantitative easing”.

He says that the Fed never bought a mortgage bond in its 100 year history until he was hired in 2009 to buy $1.25 trillion of the things! In a single year. According to Huszar Bernanke spun the scheme as a plan to help Main Street but it was really “the biggest backdoor Wall Street bailout of all time”.

Chairman Ben Bernanke made clear that the Fed’s central motivation was to “affect credit conditions for households and businesses”: to drive down the cost of credit so that more Americans hurting from the tanking economy could use it to weather the downturn.

QE may have been driving down the wholesale cost for banks to make loans, but Wall Street was pocketing most of the extra cash.