Category Archives: bailout

No Acceptable Business Case

The Chevy Cobalt is being recalled because the ignition shuts off while the vehicle is running! None of the solutions to fix it represented an “acceptable business case“, according to General Motors. Thirteen people have died so far. GM warns this can be caused by too heavy a key ring.

So, as your life passes before your eyes while barreling downhill at 80mph without power, or airbags, please keep in mind… your key ring is too damn heavy.

Acceptable Business Case

On the other hand you could have kept your key ring and GM could have fixed the problem with a 57 cent part.

At least they’re not blowing your bail out money.

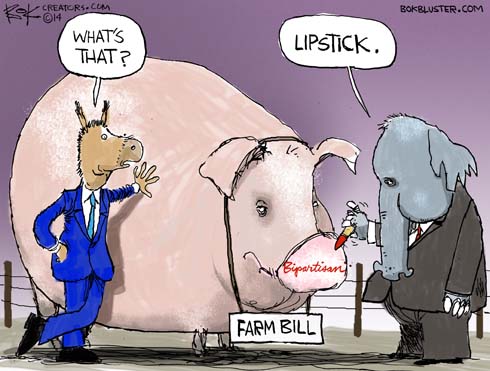

Bipartisan Farm Bill

Congress got something done last week. It passed a bipartisan, 10 year, trillion dollar farm bill.

Congress got something done last week. It passed a bipartisan, 10 year, trillion dollar farm bill.

The farm bill includes insurance against “adverse price movements”. Isn’t that what the credit default swaps were supposed to do for subprime loans before the great recession?

Bipartisanship on Farm Bill

It’s all too much for the editors of National Review who note that:

Many crop prices are near all-time highs, and if they drop as expected, new loss-protection programs could — likely will — cost billions more than the CBO calculates.

In an even rarer case of bipartisanship the Washington Post editorial board agrees:

Supposedly necessary to secure the nation’s food supply at a time of record farm income and epidemic obesity, this federal largess flows almost regardless of how much money its recipients already have.

The Post then calls on President Obama to use his pen to veto the bill.

More Bipartisan Farm Bill Update:

Bloomberg reports the Senate threw out a requirement that members of Congress would have to publicly report if they receive federally subsidized crop insurance.

Backdoor Wall Street Bailout

Our magic president has appointed a new Fed chief to make more magic money.

Our magic president has appointed a new Fed chief to make more magic money.

Janet Yellen’s Senate hearing for approval to succeed Ben Bernanke began yesterday.

Backdoor Wall Street Bailout

Andrew Huszar, a former bond buyer for the Fed, wrote an interesting apology in the WSJ this week for his role in “quantitative easing”.

He says that the Fed never bought a mortgage bond in its 100 year history until he was hired in 2009 to buy $1.25 trillion of the things! In a single year. According to Huszar Bernanke spun the scheme as a plan to help Main Street but it was really “the biggest backdoor Wall Street bailout of all time”.

Chairman Ben Bernanke made clear that the Fed’s central motivation was to “affect credit conditions for households and businesses”: to drive down the cost of credit so that more Americans hurting from the tanking economy could use it to weather the downturn.

QE may have been driving down the wholesale cost for banks to make loans, but Wall Street was pocketing most of the extra cash.

Other People’s Money in Cyprus

The EU tried to tax Cypriot savings accounts up to 10% in exchange for a bail-out of the banking system. The attempted heist was broken up by the Cyprus parliament with 36-0 vote. So now the Cyprus banks are closed until Tuesday awaiting plan B.

The EU tried to tax Cypriot savings accounts up to 10% in exchange for a bail-out of the banking system. The attempted heist was broken up by the Cyprus parliament with 36-0 vote. So now the Cyprus banks are closed until Tuesday awaiting plan B.

Arnold Ahlert says the world banking system is running out of other people’s money -“we’re all Cypriots now”.

In return f

Those Whacky Puritans

While the Mayor and Michelle go Carrie Nation on the sugar industry, the rest of us are bailing it out with price supports. Got the idea for this one from this Steve Chapman column.