Category Archives: Treasury

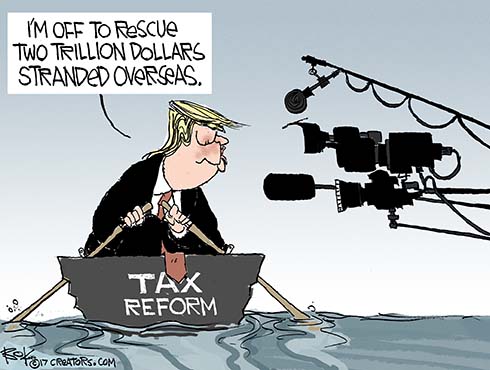

Tax Reform Rescue Mission

During a week of inspiring rescues, President Trump introduced his tax reform plan. The U.S. has the world’s highest corporate tax rate at 39%. As a result, over two trillion dollars is parked overseas in low tax countries like Ireland. Trump proposes a 15% corporate rate as ransom to rescue that cash and bring it home. Which in return will lead to growth.

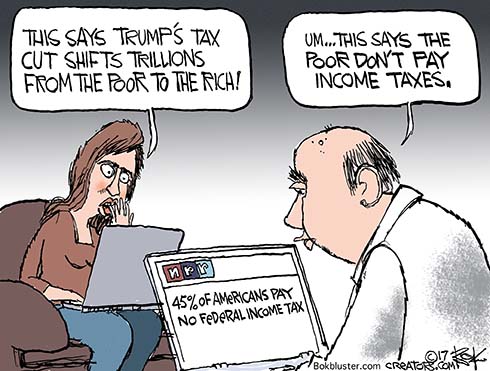

Tax Reform

Of course Democrats don’t see it that way. To them it’s all just an elitist gift to the rich. Maybe, but Kimberly Strassel points out in the WSJ that Trump is an ideal pitchman for the plan. He’s rich but he’s also seen as a populist outsider:

Mr. Trump has defined himself as the protector of America’s forgotten man, an outsider to the swamp, an America Firster. The result is that he is uniquely qualified to sell a tax plan decried as “elitist” to average Americans.

In Missouri, Mr. Trump busted up the left’s class-warfare model. He didn’t make tax reform about blue-collar workers fighting corporate America. Instead it was a question of “our workers” and “our companies” and “our country” competing against China. He noted that America’s high tax rates force companies to move overseas. He directly and correctly tied corporate rate cuts to prosperity for workers, noting that tax reform would “keep jobs in America, create jobs in America,” and lead to higher wages.

Trump Tax Plan

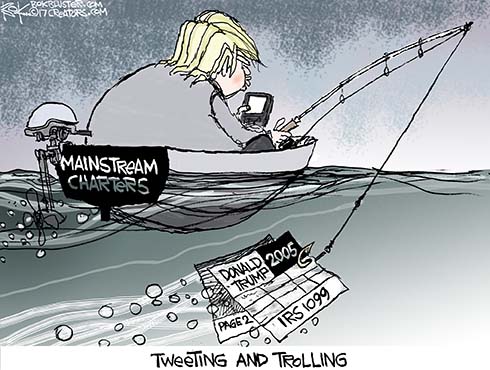

Trump Income Tax Short Form

Two pages of the 2005 Donald Trump income tax return fell in to the hands of Rachel Maddow last week. On her show she played it for all it was worth. It turns out it was worth about $38 million to Uncle Sam in taxes paid on an income of $150 million. That’s an effective rate of about 25%. The revelation made The Donald look good compared to accusations that he doesn’t pay any income taxes at all.

It also made him look good compared to Barack Obama’s 2015 effective rate of 18.5%, Bernie Sanders 2014 effective rate of 13.5%, and Mitt Romney’s 2011 rate of 14.1%

Even Van Jones called it a good night for Donald Trump.

The purloined returns showed up in the mailbox of journalist David Cay Johnston. He says he knows nothing. Revealing private income tax information is a felony.

Trump denies that he had anything to do with it.

Elephant In Debate Room

CNN says Hillary Clinton won the debate. Donald Trump disagrees but most other polls aren’t backing him up, so far.

Trump seemed to get the best of Hillary in the first 30 minutes when they tangled over trade rules. He caught her on the wrong side of President Obama’s Trans-Pacific Trade Deal, pointing out that she had called it the “gold standard.” Hillary denied this and then replied it wasn’t her responsibility and that she had changed her mind. So Trump insisted that she say it was Obama’s fault:

TRUMP: You called it the gold standard of trade deals. You said it’s the finest deal you’ve ever seen.

CLINTON: No.

TRUMP: And then you heard what I said about it, and all of a sudden you were against it.

CLINTON: Well, Donald, I know you live in your own reality, but that is not the facts. The facts are — I did say I hoped it would be a good deal, but when it was negotiated…

TRUMP: Not.

CLINTON: … which I was not responsible for, I concluded it wasn’t. I wrote about that in my book…

TRUMP: So is it President Obama’s fault?

CLINTON: … before you even announced.

TRUMP: Is it President Obama’s fault?

CLINTON: Look, there are differences…

TRUMP: Secretary, is it President Obama’s fault?

CLINTON: There are…

TRUMP: Because he’s pushing it.

CLINTON: There are different views about what’s good for our country, our economy, and our leadership in the world. And I think it’s important to look at what we need to do to get the economy going again. That’s why I said new jobs with rising incomes, investments, not in more tax cuts that would add $5 trillion to the debt.

At that point Trump seemed to be mopping the floor with her. But Hillary quickly got under his skin by trashing his business acumen and ethics.

She took a page from the Harry Reid playbook to claim Trump doesn’t pay income taxes. Incredibly, The Donald seemed to agree by saying, “it makes me smart.” For the record, PolitiFact doesn’t agree. It rates her claim mostly false.

But after that Trump seemed Low Eenergy.

Elephant In Debate Room

The elephant in debate room was the fact that Immigration, Benghazi, and the Clinton Foundation didn’t make the cut. Those issues were never brought up by moderator Lester Holt or Trump.

Unburdened of that baggage, Hillary dragged her prey off into the tall grass. There she dismembered the small handed one with accusations of racism and sexism.

She claimed the Stop and Frisk law was ruled unconstitutional and moderator Holt backed her up. She also insisted the murder rate continues to decline. In truth, Stop and Frisk was never ruled unconstitutional. And the FBI released a report the next morning showing the murder rate had surged 10.8% in 2015.

Hillary went on to back up her racism charge using Tulsa and Charlotte as “tragic examples.” Trump lacked the energy to point out that Black people rioted in Charlotte where a black man was killed by a black police officer who worked for a black police chief.

EU US Ireland Unhappy Bite Of Apple

Ireland has a 12.5% corporate tax rate. The US has a 39.5% rate.

So Apple moved its Intellectual Property operations to Ireland. And, due to a complicated 1990s agreement, the company doesn’t even pay the 12.5% rate. It’s more like .005%. (Apple did pay $3 billion in U.S. income taxes in the third quarter.) You can read how it works here, complete with a chart.

Ireland is happy with the arrangement. Apple has $200 billion parked there and employs lots of people.

EU Bite Of Apple

The U.S. is unhappy because it’s not able to take its full 39% bite out of Apple. The European Union is unhappy too.

So unhappy that it has ordered Ireland to collect $14 billion in taxes from Apple.

Now the U.S. is unhappy with the EU. The Treasury Department says the money grab damages U.S. – EU economic relations.