Tag Archives: wall street

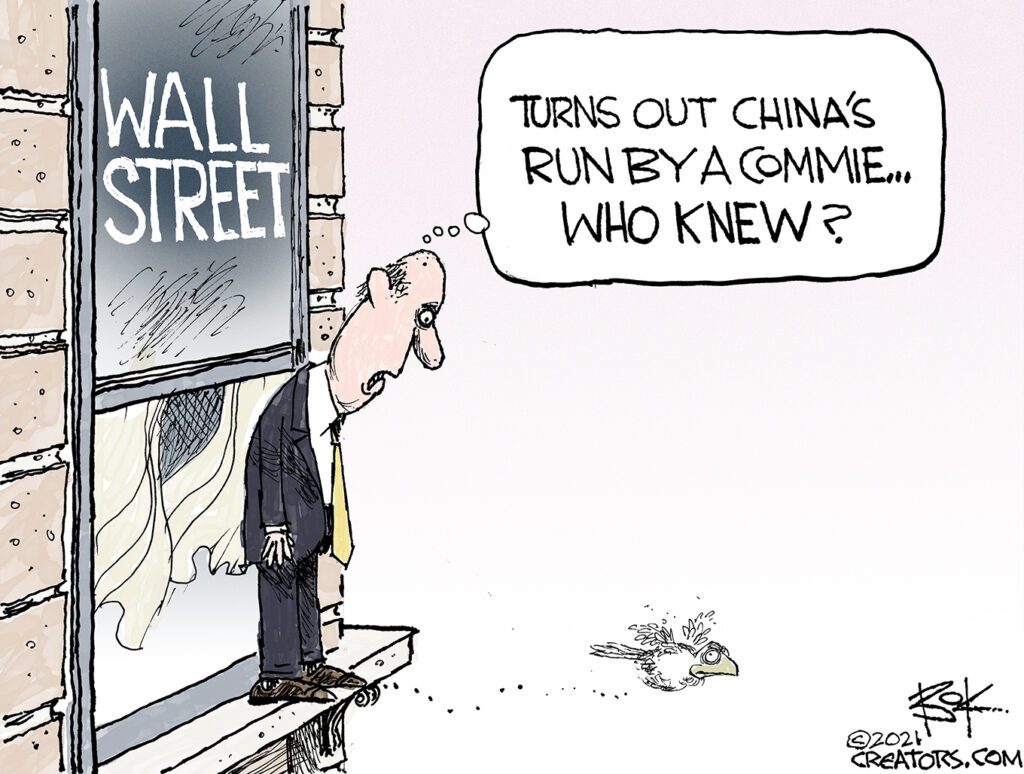

Wall Street out on a Ledge over China

Wall Street took a deep dive yesterday on news from China. Investors are afraid China’s biggest property developer, Evergrande Group, won’t be able to make payments on its debt. If that happens the company could collapse like Lehman Brothers in 2008 and take the economy down with it.

To make matters worse the Wall Street Journal (paywall) reports that Communist Party leader Xi Jinping isn’t a capitalist! He thinks private capital is running “amok.” And he wants to force China back to “the vision of Mao Zedong, who saw capitalism as a transitory phase on the road to socialism.” He even showed up in a Mao suit.

Maybe my guy on the ledge is afraid he’s on the road to serfdom.

Rumpelstiltskin

Rumpelstiltskin spun gold out of straw. Fed chief alchemist Bernanke spins dollars out of…I have no idea. But Wall Street somehow got the idea that he was thinking of not doing it any more and didn’t like it one bit.

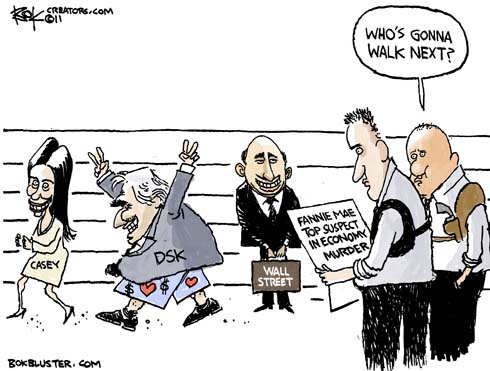

Walk the Walk

Wall Street wasn’t an innocent bystander but Gretchen Morgenson and Joshua Rosner pin the blame for the financial meltdown on Fannie Mae in their book Reckless Endangerment. They say Fannie head, James Johnson figured out how to monetize the outfit’s government backing.

Wall Street wasn’t an innocent bystander but Gretchen Morgenson and Joshua Rosner pin the blame for the financial meltdown on Fannie Mae in their book Reckless Endangerment. They say Fannie head, James Johnson figured out how to monetize the outfit’s government backing.

Under Johnson, an important Democratic operative, Fannie Mae became, Morgenson and Rosner say, “the largest and most powerful financial institution in the world.” Its power derived from the unstated certainty that the government would be ultimately liable for Fannie’s obligations. This assumption and other perquisites were subsidies to Fannie Mae and Freddie Mac worth an estimated $7 billion a year. They retained about a third of this.

Morgenson and Rosner report that in 1998, when Fannie Mae’s lending hit $1 trillion, its top officials began manipulating the company’s results to generate bonuses for themselves. That year Johnson’s $1.9 million bonus brought his compensation to $21 million. In nine years, Johnson received $100 million.

Fannie Mae’s political machine dispensed campaign contributions, gave jobs to friends and relatives of legislators, hired armies of lobbyists (even paying lobbyists not to lobby against it), paid academics who wrote papers validating the homeownership mania, and spread “charitable” contributions to housing advocates across the congressional map.

Wall Street’s Fat Finger of Fate

The Dow plunged 1000 points yesterday and bounced back 500 in about 20 minutes. Some experts suspect someone pushed the wrong button.

Early Warning System

Gordon Crovitz shows how John Paulson saw the housing crash coming and told the investment world about it through the complicated financial gadget he conjured up with Goldman Sachs. Click here for his column in the WSJ.