Category Archives: income tax

Looting the Lockbox

Republicans are said to have run up a blind alley since Boehner rejected the Senate version of the payroll tax cut. McConnell is still pushing hard for a 2 month extension of the cuts. After that, they can fight it out again – if Social Security isn’t broke yet. Where’s that lockbox?

Republicans are said to have run up a blind alley since Boehner rejected the Senate version of the payroll tax cut. McConnell is still pushing hard for a 2 month extension of the cuts. After that, they can fight it out again – if Social Security isn’t broke yet. Where’s that lockbox?

Update: House Republicans cave.

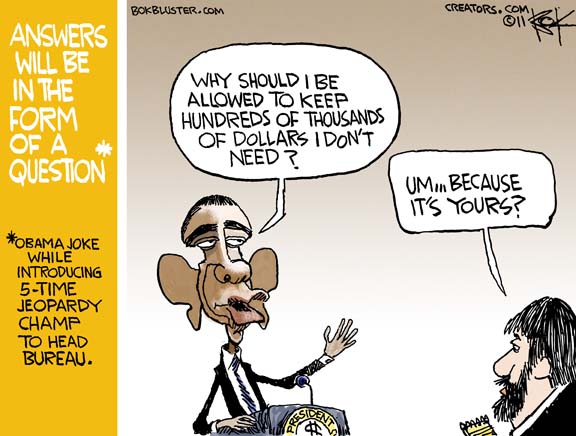

It’s a Joke, Get it?

The president reminded us he was making a little Jeopardy joke the other day as he introduced Joe the Plumber Spy, Richard Cordray, as top consumer bureaucrat.

Another joke is the way Obama likes to remind us he’s one of the elite and we’re not – unless, of course, we really are keeping hundreds of thousands of dollars we don’t need. He recently did this by targeting bestselling authors, ahem, like himself, for higher taxes. (Here’s a rude bestseller who doesn’t want to join the club). Other times he likes to try a little upwardly mobile bonding with moneybags like Mark Zuckerberg .

Gregg Easterbrook says if Obama wants to pay more taxes, he should just do it.

Don’t Tax You, Don’t Tax Me, Tax that Fellow Behind the Tree*

According to The IRS, 45% pay no income tax. The richest 1% earn 22% of all the money and pay 38% of all the federal income taxes. The richest 5% pay 60% of all the income taxes.

You could squeeze them for more but, as Walter Williams points out, the rich are smart with their money. Since 1960, whether the top marginal rate was 91% or 35%, the government take never varied more than 15-20 percent of GDP.

Rule of Law

The president has ruled the Defense of Marriage Act unconstitutional and ordered the Justice Department not to defend it.

What is the DOMA you ask? Well, according to the WSJ…

it was passed in 1996 by large majorities in both houses of Congress and signed by President Bill Clinton.

The law says the federal government will only recognize marriages that are between a man and a woman. States can still allow same-sex marriages—and five states plus the District of Columbia have done so. But people married under those state laws aren’t accepted as married under federal law.

Same sex couples get unfavorable death tax treatment under the law…

For example, a woman inheriting money from her deceased same-sex partner doesn’t get the tax benefits that federal tax law allows for a person inheriting from a spouse.

A Washington Post editorial, however, points out the two edged swordiness of the president’s approach by asking if a future Republican president might refuse to defend Obamacare from constitutional challenges.