Category Archives: Economy

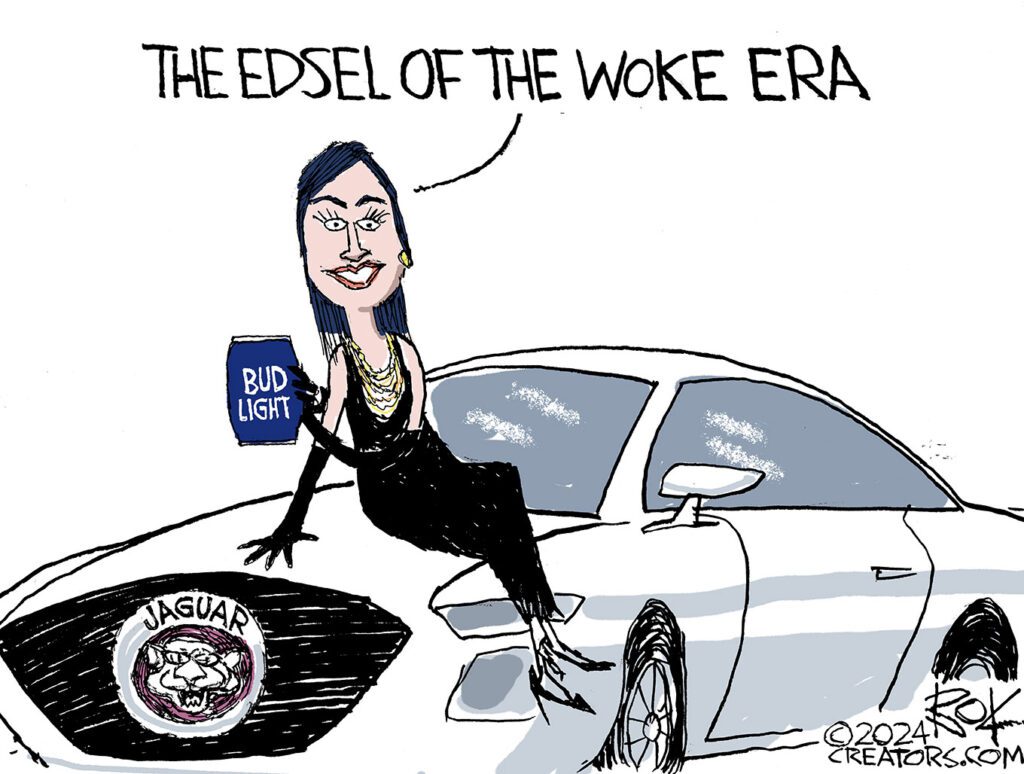

Jaguar Sells the Sizzle But No Steak

Jaguar is rebranding. The car maker came out with an ad featuring androgynous types dressed in brightly colored outfits. But no cars. It backfired, leaving the company’s managing director hurt by the motoring public’s “vile hatred” and “intolerance .”

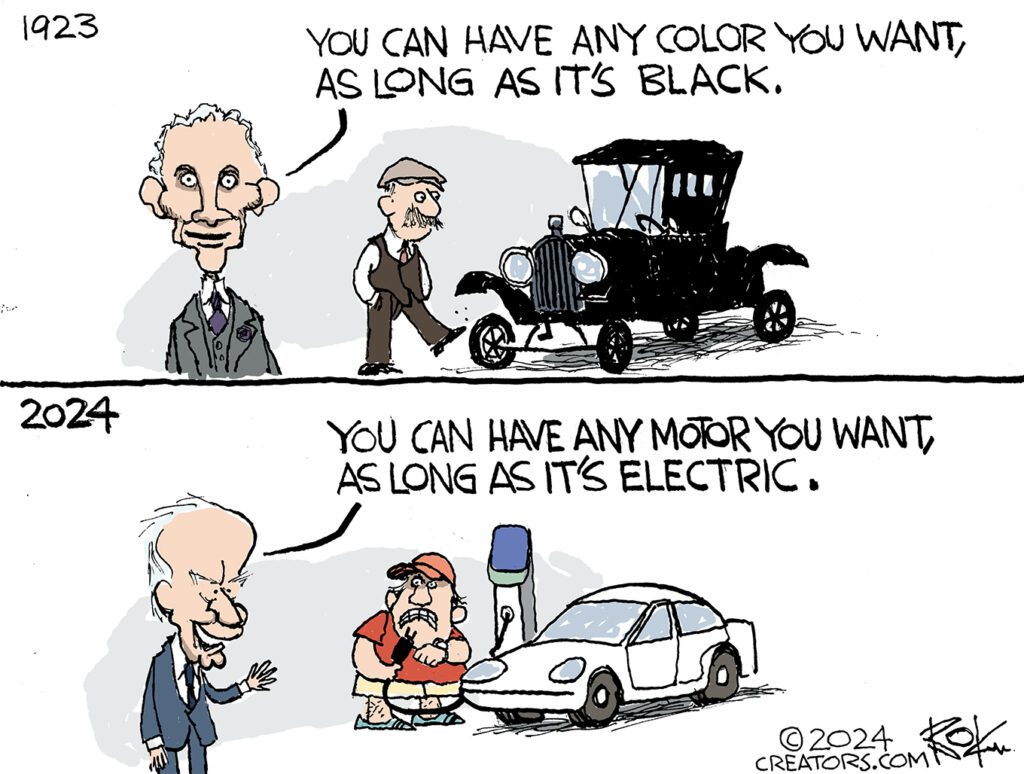

Biden Fought the Law and the Law Won… kinda

The U.S. Supreme Court ruled in 2023 that President Biden lacks the authority to cancel student loan debt. “The Supreme Court blocked it,” he admitted, “but that didn’t stop me.” Yesterday Biden canceled $7.4 billion , bringing his total student debt relief to $153 billion since the high court said, “don’t.”

The 2000s are Calling, They Want Their Landlines Back

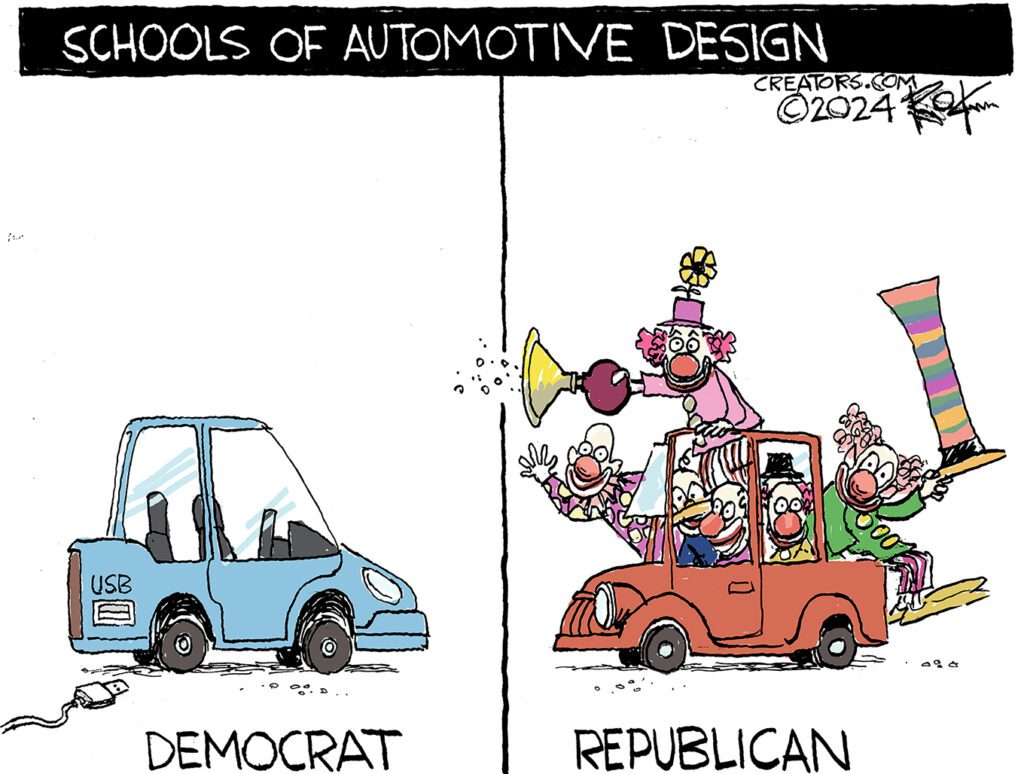

“I feel like it’s the early 2000s,” Transportation Secretary Buttigieg said in defense of the Biden administration’s EV policies which aim for 50% EV sales by 2030, “and I’m talking to some people who think we can just have landline phones forever.”