I’m a Taxpayer – Not

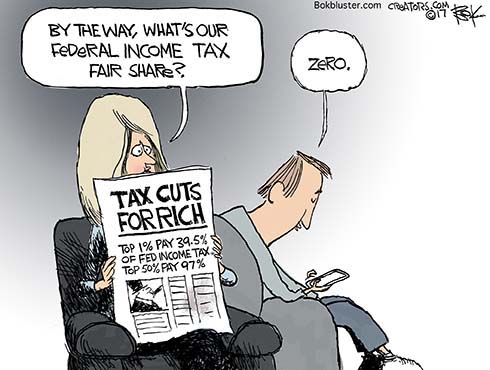

President Trump introduced his tax reform plan last week. Critics in the media labeled it “tax cuts for the rich.”

But there’s a reason for that. The rich pay most of the federal income tax.

Democrats are running against income inequality. And they’ve got a point. According to the Tax Foundation the top one percent earn twenty percent of all the income in America..

But they also pay forty percent of all the federal income taxes in the country.

Taxpayer

Half the working population can’t protest against Washington by demanding “I’m a taxpayer and ..!” That’s because they don’t pay federal income taxes. Though they do pay social security and medicare taxes.

Here’s a link to a Tax Foundation chart breaking down who pays what by percentile:

The data demonstrates that the U.S. individual income tax continues to be very progressive, borne mainly by the highest income earners.

- In 2014, 139.6 million taxpayers reported earning $9.71 trillion in adjusted gross income and paid $1.37 trillion in individual income taxes.

- The share of income earned by the top 1 percent of taxpayers rose to 20.6 percent in 2014. Their share of federal individual income taxes also rose, to 39.5 percent.

- In 2014, the top 50 percent of all taxpayers paid 97.3 percent of all individual income taxes while the bottom 50 percent paid the remaining 2.7 percent.

- The top 1 percent paid a greater share of individual income taxes (39.5 percent) than the bottom 90 percent combined (29.1 percent).

- The top 1 percent of taxpayers paid a 27.1 percent individual income tax rate, which is more than seven times higher than taxpayers in the bottom 50 percent (3.5 percent).

Chip,

I think this data is badly skewed. It sounds like a myth promulgated by pundits financed by the uber-rich.

One thing not taken into consideration is the taxes that aren’t being paid by the corporations. Look at GE, Amazon, Google, Boeing, Raytheon just to name a few. These businesses certainly aren’t paying their share of taxes (If they even pay any at all!). Also, how much of the tax money comes back to them in the form of corporate welfare? (Bailouts, cash for clunkers, wind and solar farms, inflated prices for support parts on defense contracts, just to name a few). Corporations are people. (At least I heard they are when it comes to political contributions.) Shouldn’t they pay taxes too?

What about currency debasement? If I invest my money into something to save for the future, I get taxed on any profit when I cash in my investment. We know that a greater dollar amount doesn’t necessarily mean my money has any more purchasing power. If I sell stocks to reinvest, I get taxed. Do the uber-rich get taxed when their net worth rises? They have accountants to make sure that doesn’t happen.

So much of government spending is being financed by mortgaging my future, my children’s future, my grandchildren’s future. It’s to the point where I’ve realized that the debt is never going to be paid and was never intended to be paid. We just keep creating more and more money. There’s a reason counterfeiting is against the law. Who benefits from this? Not me.

What about the bankers who create all this money? These people are collecting interest off of money that never even existed. The money you have in your wallet wasn’t even issued by the government. It came from the Federal Reserve. In fact, it really isn’t even money. It’s bank notes that are supposed to good for real money, whatever that is. It’s only good for as long as OPEC says they’ll only sell their oil only for dollars. How much tax does the Fed pay? How much money do the other banks pay? What’s going to happen when the Saudis decide they don’t want to play the game anymore.

What about the bankers that had over extended themselves in 2008? They sure didn’t hesitate to beg Uncle Sam to bail them out. (Remember when John McCain abandoned his campaign and ran back to DC? He had to save America.) When folks figured out the banks were running a ponzi scheme, why didn’t the banks have to reach into their own deep pockets to cover the cost? (Don’t expect me to believe they didn’t have the money.) Their money was probably tied up in other things to help them avoid paying taxes. They couldn’t just cash it in. (This is speculation on my part, but I think I’m probably in the bull’s-eye! What do you think?) They especially didn’t want cash in any investments and pay capital gains. If I do something stupid like this, I have to pay though the nose, or go to jail.

The only people that really pay taxes are those in the middle class. The poor get a few crumbs in order to buy their vote. Everything else is smoke and mirrors.

Hope you find time to respond. This is a sore spot for me.

Dave